You would be able to allocate your funds easily based on the discretion of your nonprofit and based on which programs have the greatest need at your organization. One of the challenges of restricted funds is that they present another factor to take into account when making these allocations. Use your various statements and the information in your chart of accounts to be sure your budget adequately reflects the unrestricted funds in your system and leverages the temporarily restricted funds as they’re designed to be used.

8A Restricted assets – before adoption of ASU 2022-03

Investment advisory services are offered through CliftonLarsonAllen Wealth Advisors, LLC, an SEC-registered investment advisor. Since RSUs are not actually stocks but only a right to the promised stock, they carry no voting rights. Once converted, the stock carries the standard voting rights for the class of stock issued.

- Once the conditions are satisfied, these assets can be reclassified as unrestricted.

- This type of asset requires meticulous record-keeping and transparent reporting to demonstrate adherence to the donor’s long-term vision.

- Being unrestricted, the non-profit can then use the donation for whatever purpose it sees fit to achieve its stated mission.

- The restrictions are intended to discourage premature selling that might negatively affect the company and to provide stability at the firm by providing a benefit to employees who stay on for a certain amount of time.

- Permanently restricted assets are funds of a nonprofit organization that must be used in designated ways and whose principal cannot be touched.

Restricted Stock: What It Is, How It Works, Selling & Taxation

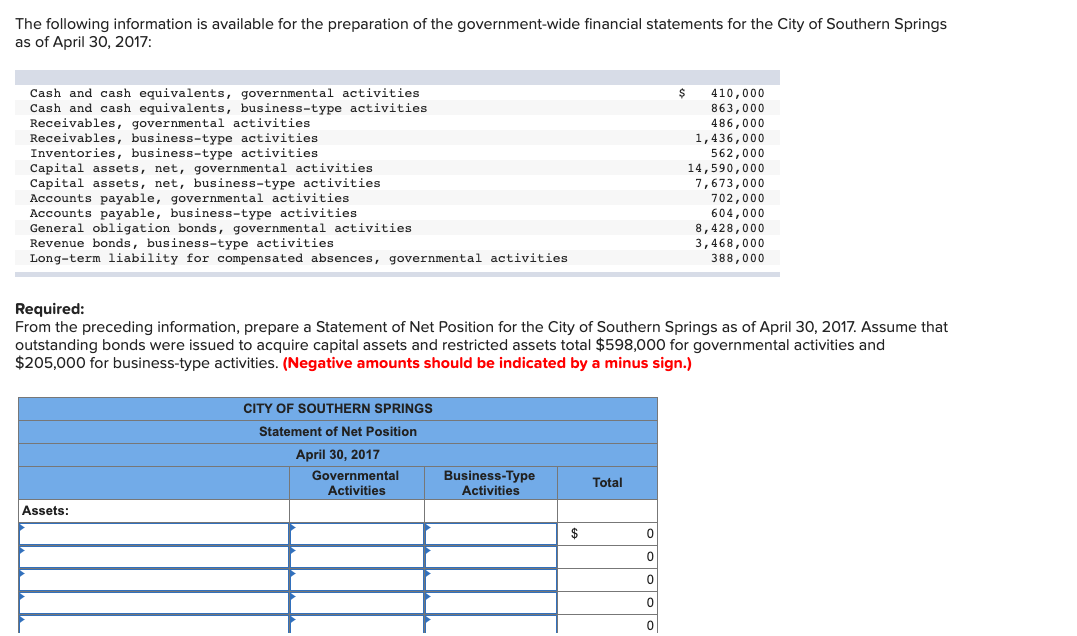

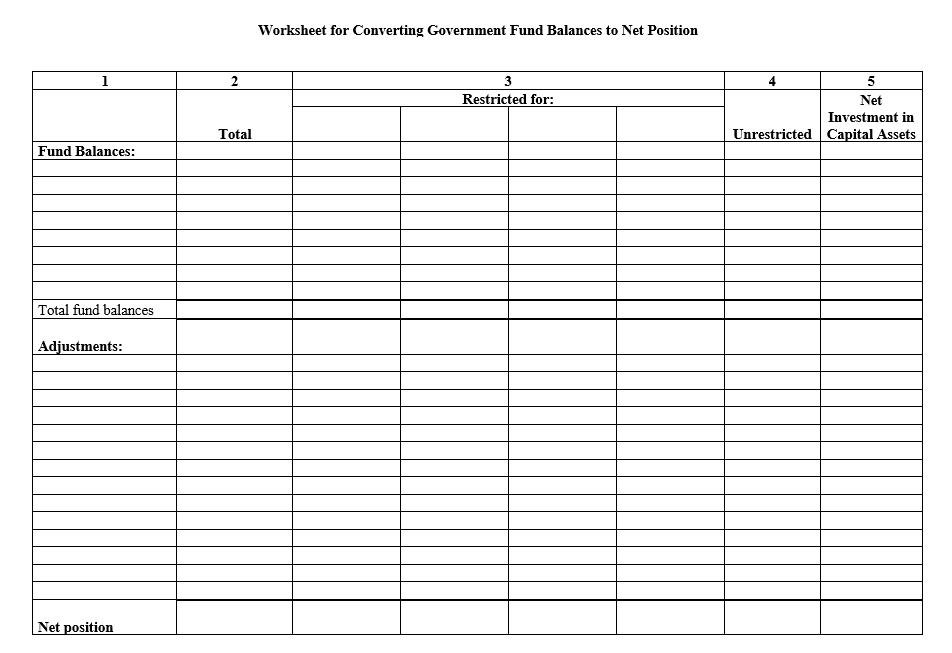

When these resources are used to acquire fixed assets, the not-for-profit entity must report the resources as having been released from restriction, effectively reclassifying the fixed assets as net assets without donor restriction. Using the Andrew Carnegie example, if Carnegie stipulated that the dividends from his donation were to be used for a specific purpose, those dividends would be treated as a temporarily restricted assets as they are received. If there were no stipulations, the dividends would increase unrestricted net assets. In either case, the stock itself would be accounted for as a permanently restricted net asset. From this statement, nonprofits can calculate their months of LUNA (liquid unrestricted net assets) to determine their liquidity and flexibility to assume risk and expand their operations. You can find this calculation by subtracting the property and equipment (non-liquid assets) from the net assets without donor restrictions.

How Restricted Stock Works

For example, let’s say a science museum with a 501(c)(3) designation offers week-long summer day camps for children. To make advance planning easier for the organization, signups open in February each year. Therefore, until the actual summer camp session rolls around, the registration fees are considered deferred revenue. For example, let’s say a donor contributes a gift to an organization that specializes in helping the homeless population. The donor’s friend struggled with homelessness and confided in them about the challenges of getting food on a regular basis, so the donor wants to be sure their contribution is dedicated toward the serving kitchen at the organization.

Restricted Fund Management for Nonprofit Organizations

Whether you’re allowed to do this will depend on the agreement made between your nonprofit and the donor upon receiving the contribution. The reclassification process also involves updating financial statements to reflect the change in the nature of the net assets. This ensures that stakeholders have an accurate understanding of the what are restricted assets organization’s financial position. Transparency in this process is crucial, as it demonstrates the nonprofit’s commitment to honoring donor restrictions and maintaining financial integrity. Regular communication with donors about the status of their contributions can also help manage expectations and build long-term relationships.

Free Resources

This differs from stock options, which are taxed when employees exercise their options, not when vested. Restricted stock and employee stock options are forms of equity compensation furnishing employees with shares in their company. However, restricted stocks are different from stock options, which are derivatives that outside investors can trade.

Restricted cash is classified as either a current asset, which is used up within one year, or a non-current asset, which are long-term assets. As a result, if the restricted cash is expected to be used in the short-term, it is classified as a current asset. If it is not expected to be used within a one-year time frame, it is classified as a non-current asset. Since funds are separated on the balance sheet/income statement, restricted cash typically appears on a company’s balance sheet as either “other restricted cash” or as “other assets.”

These include the Salvation Army, Girl Scouts, United Way, and organizations dedicated to social issues like curing or treating disease. Functional categories include fundraising and management and general, as well as individual programs that the organization has undertaken. In contrast, natural categories include salaries and benefits, supplies, professional fees, depreciation, and interest, among other operating costs and expenses. A restricted fund is a reserve account that contains money that can be used only for specific purposes. Restricted funds provide reassurance to donors that their contributions are used in a manner that they have chosen. They most often appear in the context of funds held by certain nonprofits, universities, or insurance companies.